- Householdquotes.co.uk

- Blog

- Heat Pump Statistics

Heat Pump Statistics 2025

Across the globe, efforts are ongoing to reduce our use of fossil fuels and bring us closer to net zero emissions. Heat pumps have become one of the key tools in our efforts to make this happen, but for many years, people have been left feeling confused or unsure about using this new technology.

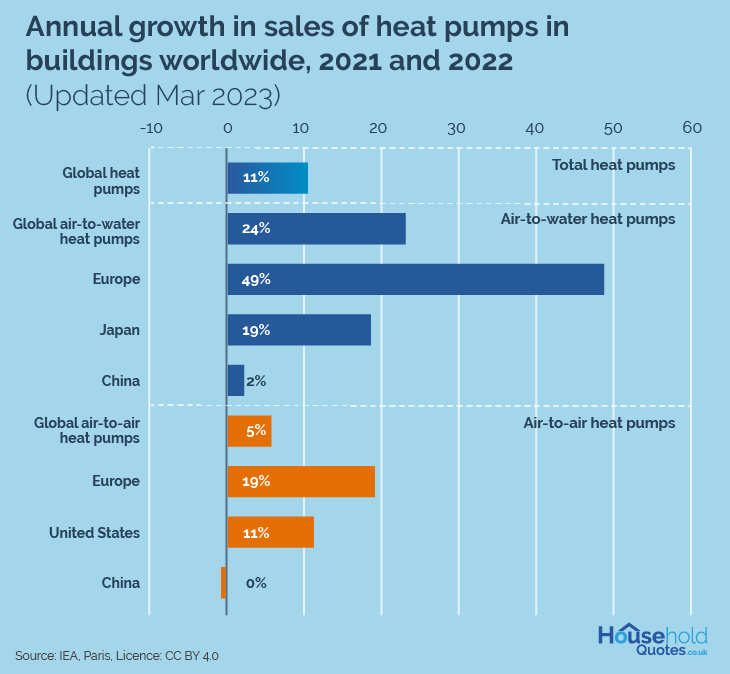

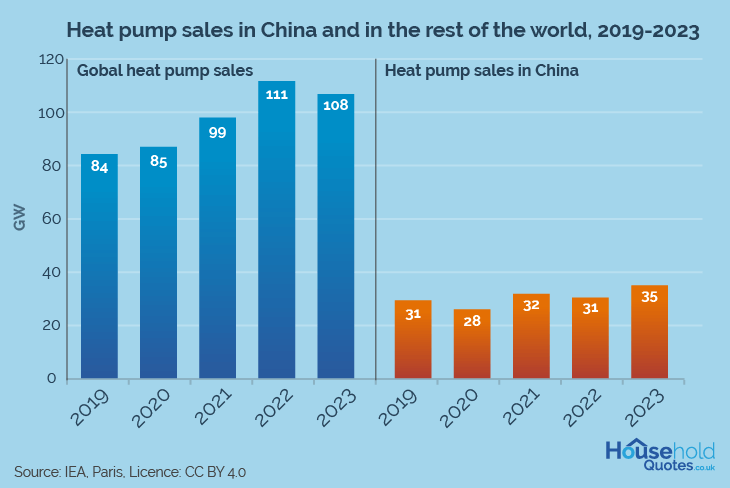

With costs and concerns around accessibility, many homeowners have been reluctant to make the switch. Despite these hurdles, however, recent reports indicate significant growth in the market, with the latest data estimating global heat pump sales increased by 11% in 2022.

There are also promising increases here in the UK, as applications for the Government heat pump incentive reported over 4,000 installations in February alone! This incentive, part of the Boiler Upgrade Scheme, offers financial support to homeowners and businesses looking to switch to heat pumps. To better understand global heat pump market trends, we’ve researched the latest data and reports to gather the best insights in one place.

Through this article, we’ll discover the global heat pump statistics for 2024, exploring the reasons behind the growth, the regional trends, costs, and savings, as well as what this means for the future of heating and cooling our homes worldwide.

Global heat pump statistics in 2025

Energy efficiency is becoming a top priority as the world grapples with climate change. With home heating still a major contributor to global emissions, heat pumps are hoped to be the route to a cleaner, more sustainable option.

Although data for 2023-24 is still emerging, we’ve studied the latest insights and reports on heat pump statistics. Below are some of the key points we found:

- Heat pumps currently cover around 10% of all heating needs globally. It’s estimated that 1 in 10 homes are now using heat pumps.

- Current heat pump models are now 3-5 times more efficient than gas boilers.

- Gas boilers emit around 2,500kg of C02 each year, whereas heat pumps can emit only around 850kg.

- Global heat pump sales increased by 11% in 2022, with further growth expected in the coming years.

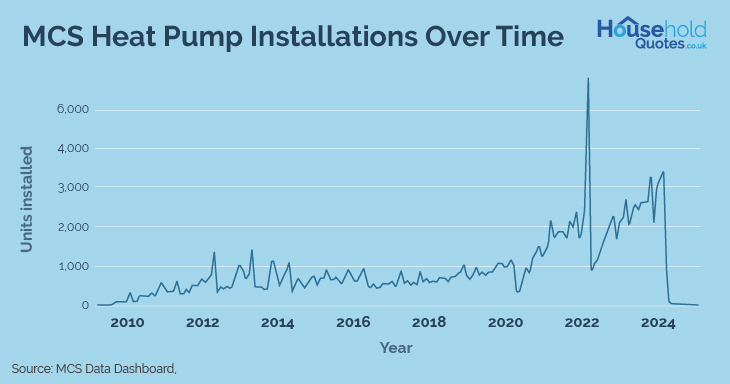

- Over 4,000 heat pumps were installed in the UK during February 2024 as part of the Government’s Boiler Upgrade Scheme (via MCS). This was a 26% increase on the 2023 average.

- The global market is estimated to be worth approximately £98.6 billion in 2024. Predictions for future growth vary from approx. £124.8 billion by 2029 to £159.3 billion by 2032. Estimates for CAGR (compound annual growth rate) are between 8.2 and 11.1%.

- If growth rates continue, the IEA suggests heat pumps could be warming nearly double the number of buildings by 2030.

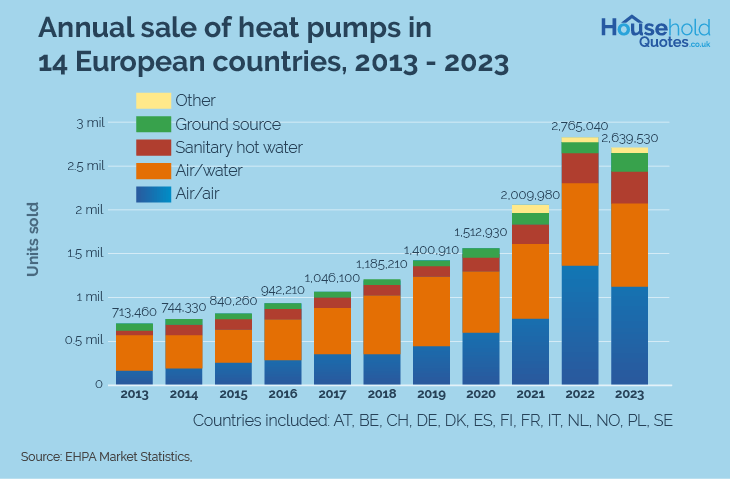

- European sales rose in 2022, with the sale of almost 3 million heat pumps. In 2023, however, the EHPA (European Heat Pump Association) reported a 5% drop in sales across 14 European countries. Dropping from 2.77 million to 2.64 million.

- The EHPA predict the total European heat pump stock to be 23 million (including 27 EU countries, the UK, Norway and Switzerland).

- IEA estimates that heat pumps can reduce CO2 emissions globally by at least 500 million tonnes in 2030. This is the equivalent of the yearly emissions of every car in Europe.

- Heat pump purchases overtook those of gas furnaces in the US in 2023. While China still holds the largest market share of heat pumps, with stable sales figures despite a slower economy.

- Despite growth in the heat pump sector, reports suggest that global commitments to meet net-zero targets are still very ambitious, with further government policy action and international cooperation needed. Furthermore, around 600 million more heat pumps are required by 2030 to cover just 20% of building heating.

Heat pump global market growth and trends

The global heat pump market is experiencing impressive growth, with overall sales and adoption rates rising. According to recent reports, the market size in 2024 is estimated to be worth approximately £71 billion, with a growth potential of £124.5 billion by 2029. This impressive prediction reflects a Compound Annual Growth Rate (CAGR) of 11.8%.

While this is just one insight, most market analysts predict that growth in the heat pump market will continue. This is driven by rising energy costs, increasing environmental concerns, and government initiatives.

In some parts of the world, 2024 has proven to be less encouraging than expected - in parts of Europe, for example, reports suggest a 5% decline in sales throughout 2023. However, looking more closely at the largest markets can offer a clearer picture of these trends and forecasts.

Heat pump types

Before discussing heat pump sales, it’s good to recognise the different types of heat pumps and how they play a role in the adoption rates of this renewable technology.

In recent years, air source heat pumps have been the most popular choice, with a market share of over 84% in 2023. These include air-to-air and air-to-water models, often cheaper and more easily installed heat pump options.

Ground source heat pumps (geothermal) account for a much smaller percentage of the market. For example, only around 2.5% of all installations across the European Union were geothermal in 2020.

Hybrid systems combine heat pumps with gas boilers and are also popular choices. In Italy, for example, they accounted for more than 40% of sales in the air-to-water segment in 2022.

World

Across the globe, heat pump uptake is on a steady incline. As Government policy commitments to net zero come into action and increased incentives encourage more people to choose a heat pump, the effects are becoming more visible.

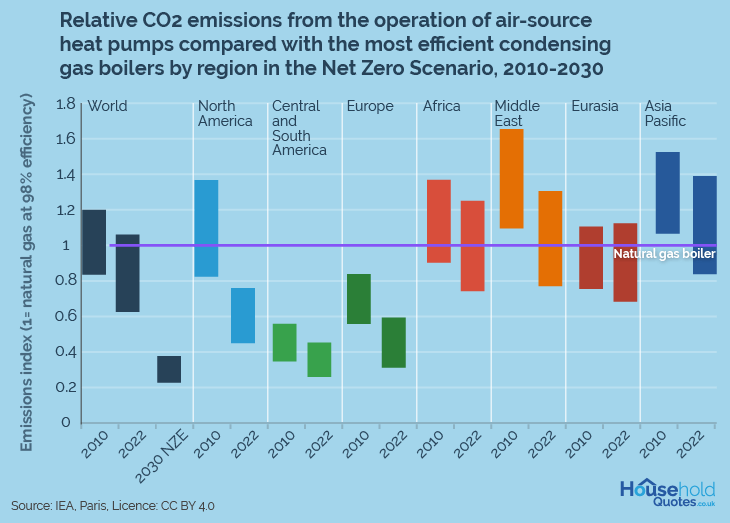

The use of air-source heat pumps, for example, has reduced CO2 emissions from home heating in nearly all major areas of the world, compared to using a gas boiler. The latest findings from the International Energy Agency (IEA) note that CO2 emissions from air-source heat pumps are, overall, much lower compared to the levels recorded in 2010. This is particularly notable across America and Europe. However, levels are still declining in other major areas, which is a positive sign.

Europe

If we look closely at trends and market share in Europe, we can better understand how heat pumps are used. In the chart below, created by the European Heat Pump Association (EHPA), we can see a clear distinction between heat pump types across 14 EU countries over the last 10 years. This gives us a good indication of the popularity of different heat pump types and clearly shows the higher desire for air-source varieties.

The European heat pump market has witnessed phenomenal growth since the early 2010s, solidifying itself as a global leader. According to the EHPA, sales in Europe skyrocketed by nearly 40% in 2022, reaching a record high of approx. 3 million heat pump units sold.

This surge in heat pump adoption in European countries can be attributed to several factors. These include:

-

Rising energy costs:

Europe's dependence on imported fossil fuels has made it particularly vulnerable to price fluctuations. Heat pumps, powered by electricity, offer a more stable and potentially cheaper long-term heating solution than traditional gas or oil boilers.

-

Environmental concerns:

Europe is a leader in tackling climate change, and heat pumps align perfectly with those goals. They boast high efficiency and significantly lower carbon emissions than traditional heating systems. Studies suggest heat pumps can reduce CO2 emissions by up to 80% compared to gas boilers.

-

EU policy push:

The European Union (EU) has been a driving force behind these sales figures. Ambitious energy efficiency targets and directives like the Energy Performance of Buildings Directive (EPBD) and the REPowerEU plan have encouraged the use of renewable heating solutions. This has made heat pumps an attractive option for new and existing buildings.

The EU has further plans to double the annual heat pump deployment rate by 2025 compared to 2015 levels. Predictions from the International Energy Agency (IEA) suggest that Europe’s gas demand for heating will be lowered by 21 billion cubic metres in 2030, due to the adoption of heat pumps.

Whilst environmental factors can largely drive policy decisions and incentives, we cannot avoid the unique pressures on energy supplies that Russia's invasion of Ukraine has caused. This also inspired the EU to launch its REPowerEU in May 2022, which has already achieved the following:

The EU has reduced its dependence on Russian fossil fuels saved almost 20% of its energy consumption introduced the gas price cap and the global oil price cap doubled the additional deployment of renewables.

- The EU is working to reduce fossil fuel imports by doubling the rate of heat pump installations. They aim to install around 10 million more heat pumps by 2027. Additional plans include a phase-out of boilers by 2029 and a further 30 million heat pump installations by 2030, according to the Green Deal Industrial Plan.

-

Technological advancements:

Heat pump technology has seen significant advancements in recent years. Improved efficiency, wider operating ranges (allowing functionality in colder climates), and quieter operation make heat pumps more viable for various climates and building types.

-

Government incentives:

Many European countries offer financial incentives like tax breaks or subsidies to encourage homeowners and businesses to switch to heat pumps. These incentives further accelerate market growth. For instance, France offers a tax credit scheme that can cover up to 46% of the installation cost of a heat pump.

Despite all the positive efforts and increase in sales, the European market did see some decline in 2023. Analysis by the EHPA concluded that sales fell by 5% across 14 countries, taking sales from 2.77 million to 2.64 million.

The decline is assumed to be caused by a postponement of the EU’s Heat Pump Action Plan. The plan was set to help the technology industry with training, financing and ongoing support to bring more heat pumps and energy savings to homes and businesses.

Daikin, one of the leading heat pump manufacturers, also stated the decline in sales was due to a large drop in gas prices and higher inflation and interest rates. Higher electricity prices and uncertainty about government policies have unsettled investors and consumers.

UK

While not quite at the forefront like its European counterparts, the UK heat pump market is experiencing a surge of interest and is poised for significant growth. The early part of 2024 showed some encouraging data through the Government-backed Boiler Upgrade Scheme (BUS).

According to MCS reports (the certification body ensuring installations comply with UK standards), over 4,000 heat pumps were installed in February 2024 alone. Recent figures suggest a 26% increase in the monthly install average compared to 2023.

While MCS installers don’t account for every heat pump installation, there is a good chance that these numbers are even higher. According to OFGEM figures, over 22,300 BUS vouchers have been redeemed between May 2023 and February 2024 - with a total of 35,741 applications received.

Looking at this MCS installation chart, we can see an upward trend in the rate of installations since 2010. The spike in 2022 can be directly attributed to the BUS launch in May of that year - showing just how important the Government support scheme is to the country's mission to install more heat pumps.

The Government also reported an overall increase of 39% in the number of applications to the scheme at the start of 2024. This follows an increase to the scheme value in September 2023, which uplifted the available grant to £7,500 on the previous offer of £5,000 - £6,000.

According to the Energy Saving Trust, installing an air source heat pump in the UK can cost around £14,000. So, while the Boiler Upgrade Scheme won’t cover the full cost of an installation, it is closer to cutting the price in half than it has been previously.

When looking at the UK heat pump market, it’s interesting to see how heat pumps are being adopted around the country. The following charts show the split across the UK of different heat pump types and their most prominent locations.

| Air Source Heat Pump Installations By Location | ||

|---|---|---|

| Local Authority | MCS Certified Installations Total | % of Households with Installations |

| Na h-Eileanan Siar | 2,457 | 19.05% |

| Orkney Islands | 1,059 | 11.39% |

| Argyll and Bute | 3,248 | 7.94% |

| Shetland Islands | 782 | 7.45% |

| Ceredigion | 1,986 | 6.43% |

| Highland | 5,850 | 5.00% |

| Dumfries and Galloway | 3,308 | 4.69% |

| Isle of Anglesey | 1,345 | 4.37% |

| Powys | 2,616 | 4.35% |

| Gwynedd | 1,596 | 3.12% |

| Ground Source / Water Source Heat Pumps Installations By Location | ||

|---|---|---|

| Local Authority | MCS Certified Installations Total | % of Households with Installations |

| Orkney Islands | 129 | 1.39% |

| Ceredigion | 226 | 0.73% |

| Cornwall | 1,682 | 0.67% |

| East Lindsey | 435 | 0.67% |

| Cotswold | 268 | 0.66% |

| Shetland Islands | 66 | 0.63% |

| Powys | 347 | 0.58% |

| Shropshire | 754 | 0.54% |

| Stratford-on-Avon | 305 | 0.51% |

| Herefordshire, County of | 417 | 0.50% |

| Other Heat Pump (Hybrid) Installations By Location | ||

|---|---|---|

| Local Authority | MCS Certified Installations Total | % of Households with Installations |

| Orkney Islands | 157 | 1.69% |

| Brighton and Hove | 87 | 0.07% |

| Greenwich | 53 | 0.05% |

| Hackney | 31 | 0.03% |

| Neath Port Talbot | 17 | 0.03% |

| Perth and Kinross | 13 | 0.02% |

| Highland | 17 | 0.01% |

| Camden | 8 | 0.01% |

| Na h-Eileanan Siar | 1 | 0.01% |

| Mid-Suffolk | 2 | 0.00% |

We have seen how Government incentives such as the BUS have helped encourage heat pump uptake, but there are other causes for the rise in figures. For example, the UK government has recognised the potential of heat pumps and is actively promoting their adoption. The Heat and Buildings Strategy aims to decarbonise homes and buildings by installing 600,000 heat pumps annually by 2028.

Changing the heating landscape across the country is crucial if we reduce our impact on the planet. A statement on the matter from the EST said:

Household emissions from heating and hot water must reduce by 95% to reach 2050 net-zero targets. The UK needs a revolution in how we heat our homes in the next few years to achieve the necessary carbon emission savings.

The UK has set ambitious decarbonisation targets and recognises the need to reduce emissions from the heating sector. Heat pumps align with these goals with their high efficiency and lower carbon footprint. Studies suggest a well-designed heat pump system can reduce CO2 emissions by up to 70% compared to a gas boiler.

There is also a growing emphasis on integrating heat pumps with renewable energy sources like solar panels. This further allows homeowners to reduce their carbon footprint and potentially benefit from increased energy independence.

While the UK heat pump market is still in its early stages compared to Europe, the future seems promising. If current trends continue, the UK could witness a significant increase in heat pump adoption in the coming years.

America

The United States heat pump market, while experiencing steady growth, hasn't reached the levels seen in Europe. However, signs indicate a potential for heat pump technology to take off. In 2022, heat pump sales overtook those for gas furnaces for the first time. This is significant because the US traditionally relies heavily on natural gas for space heating.

The heat pump market in America has started to grow steadily in recent years, with a CAGR exceeding 8%. In 2023, the US market reached a value of £46 billion. A recent study revealed that heat pumps were being used in apartments twice as often in 2020 as in 2015.

This uptake of heat pump technology is thought to be due to several factors, including:

-

Policy changes

The US federal government has taken steps to encourage heat pump adoption through tax credits and rebates - such as the Energy Efficient Home Improvement Credit, which offers a 30% tax credit for the total cost of the installation. However, additional policy support can vary significantly at the state and local levels, so some states with ambitious clean energy goals, like California and New York, can offer additional incentives.

-

Energy efficiency:

Rising energy costs are a growing concern in the US. With their high efficiency, heat pumps offer a compelling solution for homeowners looking to reduce their energy bills. Additionally, some utilities offer special rates for heat pump users, further enhancing their economic appeal.

-

Environmental considerations:

Sustainability concerns are increasingly influencing US consumer choices. Heat pumps' lower carbon footprint than traditional heating systems like oil furnaces is a positive factor. While not the primary driver yet, environmental benefits are gaining weight in purchase decisions.

-

Technological advancements:

Similar to global trends, US heat pump technology is constantly evolving. Cold-climate heat pump technology developments are particularly relevant as they address concerns about performance in colder regions. Additionally, smart grid integration and noise reduction advancements make heat pumps more attractive for a wider range of applications.

Although the US heat pump market appears to be playing catch-up, a range of factors, like rising energy costs, increasing environmental awareness, and technological advancements, are creating a fertile ground for future growth. With continued policy support and innovation, heat pumps could become a mainstream heating solution in the US, contributing significantly to a cleaner and more sustainable energy future.

Asia-Pacific

The Asian heat pump market is a global leader, boasting the largest market share and experiencing significant growth. With a market size estimated at over £36 billion in 2023, the region is expected to exceed a CAGR of 9% in the coming years.

China is the world’s largest heat pump market, accounting for over a quarter of all global sales. In 2023, the Chinese market saw a 12% growth in sales, which is promising when you consider that China’s main heating source is predominantly coal.

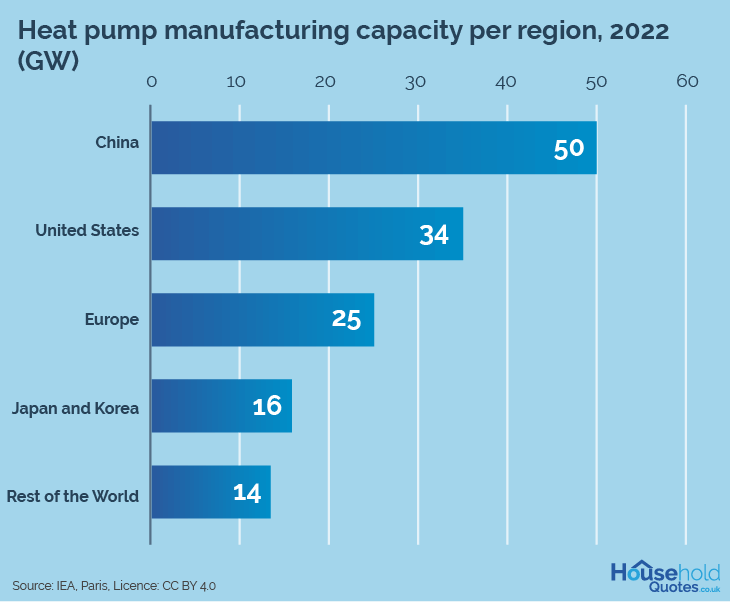

In this graph, we can see just how much of the market is dominated by China when compared to global sales. One major reason is that China is the leader in the production and innovation of heat pump technology. Around 35% of the world’s heat pumps were produced in China in 2022. In the chart below, we can see how this compares to other major areas.

While China may dominate the market, other Asian economies like Japan and South Korea are witnessing steady growth in heat pump adoption, driven by factors like energy efficiency concerns and government support.

Ductless heat pumps, ideal for retrofitting existing buildings and providing zone-specific heating/cooling, are witnessing significant growth across Asia. The market size for these was estimated to be £2 billion in 2023, with predicted growth rates of more than 5% between 2024 - 2032.

The Asian heat pump market is a powerhouse fueled by technological advancements and a growing demand for sustainable and efficient heating solutions. This region is expected to continue shaping the future of heat pump technology and its global adoption.

Heat pump adoption data per country

We’ve seen how vast and progressive the global heat pump market is, with various policies and key driving factors helping to increase the use of heat pumps in different countries. To get an even clearer picture of just how far some countries are going (or how far they still need to go!), we’ve calculated the rate of heat pump adoption across selected countries.

| Heat Pump Adoption Per Country | |||

|---|---|---|---|

| Country | Population (Estimate) | Number of Heat Pumps Installed* | Percentage of Households with Heat Pumps |

| China | 1.4 billion | 58.4 million | 33% |

| United States | 333 million | 17.2 million | 14% |

| Japan | 125 million | 8.5 million | 81% |

| Norway | 5.5 million | 1.51 million | 60% |

| Sweden | 10.5 million | 1.59 million | 43% |

| Finland | 5.5 million | 1.13 million | 41% |

| Estonia | 1.3 million | 180,200 | 34% |

| United Kingdom | 66.9 million | 200,000+ | 1% |

Whilst these figures are only a rough estimate, it’s interesting to see the difference between countries with lower populations, such as Finland and Norway, having a much larger percentage of heat pumps in homes than countries such as the UK or the US. It just highlights the different policies and accessibility issues that are in place.

Adoption barriers

Installing a heat pump sounds straightforward, and when you list the benefits of doing so, it is a very positive heating choice. There are, however, still many barriers that are causing such low adoption rates in some countries. Here are some of the key points:

Upfront and installation costs

We know that this will vary between countries, but the nature of heat pump technology is still new and evolving - the price of these units is costly.

In the UK, the installation of an air source heat pump is estimated to cost around £14,000. This can double to £28,000 for a ground source heat pump or even go as high as £57,000. If you compare these to typical boiler costs, these are more likely to be between £3,700 - £5,500. This is a huge difference and can be why more consumers stick with non-renewable options.

Government incentives worldwide differ greatly; some will offer easier access to this technology than others. In the UK, the only direct way to fund support is through the Boiler Upgrade Scheme. If you are successful in your application, though, the highest amount you can get towards the installation cost is £7,500, meaning you will still be looking for at least £6,500 of your own money.

Market analysts at CMR provide insight into these hurdles:

This financial burden may discourage potential adopters and slow down market penetration. Addressing this challenge requires technological innovations, increased efficiency, and policy interventions or incentives to make heat pump systems more economically viable for a broader consumer base.

However, further progress is being made, as financial support has increased recently, particularly in countries such as the United States, Poland, Ireland and Austria. These aim to bring the cost of heat pumps closer to traditional boilers or furnaces.

Infrastructure

Despite many manufacturers claiming heat pumps are ‘suitable for all homes’, there are some cases where homes simply don’t have the space or the efficiency to benefit from a heat pump.

Whilst ongoing technological innovation has meant models are now more suitable for more homes and climates than ever, some older homes or flats simply won’t be able to go ahead with an installation.

In addition, many countries still rely on their central electricity grid to provide power for a heat pump. With volatile energy prices, many consumers will choose lower-priced fossil fuels over costly electricity.

Environmental impact of heating options

| Technology | Efficiency Potential | Typical Annual CO2 Emissions (kg) | Emissions Notes |

|---|---|---|---|

| Gas boiler | 92+% | 5,100 - 7,400 | Depends on boiler use and maintenance. |

| Air to water heat pump | 200 - 400% | 1,500 - 3,500 | It varies depending on climate, the heat pump's efficiency, and the electricity grid's carbon intensity. |

| Air-to-air heat pump | 300% | 1,000 - 2,500 | Similar factors are found in air and water heat pumps. |

| Ground source heat pump | 350% | 1,000 - 2,000 | Generally considered the most efficient, with less variation in emissions compared to air-source pumps. |

| Hybrid heat pump | Varies | Varies | It depends on how often the gas boiler and heat pump operate. It can be as low as an air-to-water heat pump if the boiler rarely runs. |

For a truly eco-friendly heating solution, a heat pump paired with a renewable energy source like solar panels is a clear winner. It minimises reliance on fossil fuels and reduces greenhouse gas emissions.

Even with a conventional electricity grid, heat pumps still offer some environmental benefits due to their superior efficiency. As renewable energy sources continue to gain traction, heat pumps are poised to become the environmentally responsible choice for home heating.

Future trends and projections

The global heat pump market is poised for significant growth in the coming years, with estimates suggesting a Compound Annual Growth Rate (CAGR) exceeding 9% until 2030. Air-to-water heat pumps, offering space heating and hot water capabilities, are expected to lead this growth.

Furthermore, the market is witnessing exciting trends such as:

-

Heat pump electrification: A shift from fossil fuel heating systems towards electric heat pumps powered by renewable energy sources.

- Smart heat pump technology: Advancements in connectivity and smart controls will further enhance heat pump efficiency and integrate them seamlessly into smart home systems.

Despite the promising outlook, challenges remain. The upfront cost of heat pumps can be higher than traditional systems. However, government incentives and cost reductions due to increased production are expected to ease this barrier. Additionally, upgrading the electricity grid infrastructure in some regions will be crucial.

Overall, the future of the heat pump market looks promising. The market is expected to continue on a positive upward tilt, driven by growing energy efficiency demands, government policies, technological advancements, and decarbonisation initiatives.

Becky has been bringing quality advice to homeowners since 2021. As an experienced writer, she is keen to help our customers find the help they need when they need it.