- Householdquotes.co.uk

- Blog

- Renting vs Buying

Renting vs. Buying Property in the UK: A 2024 Perspective

- By the end of 2024, the Bank of England is anticipated to begin cutting interest rates from 5.25% to 4.5% which could boost investor confidence.

- Rental affordability is currently at its lowest point in a decade, with an average UK tenant spending about 30% of their monthly income on rent.

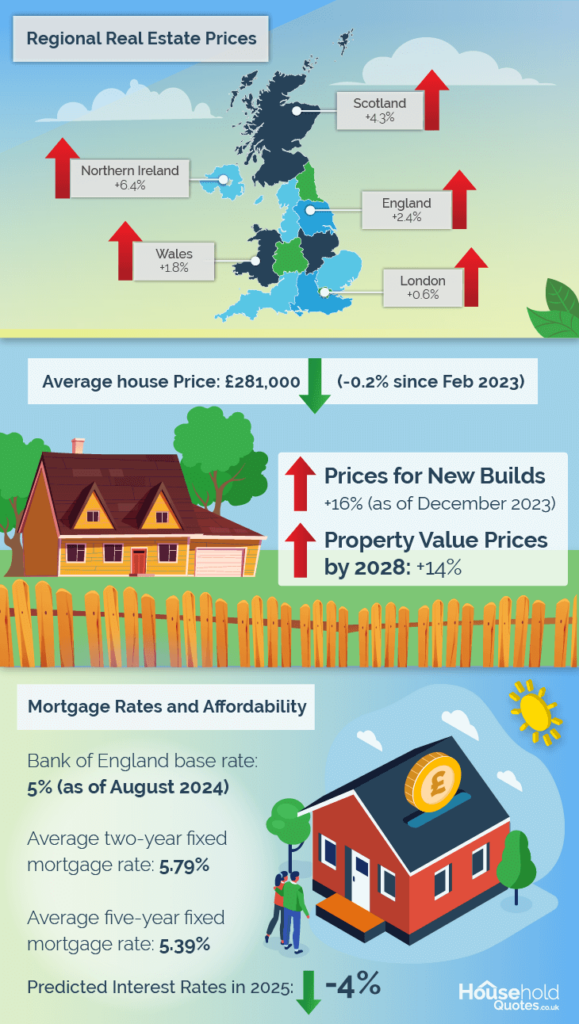

- The average UK house price is £281,000 as of February 2024 which is 0.2% lower than in February 2023.

In today's dynamic housing market, the decision between renting and buying a home is more complex than ever. With fluctuating property prices, shifting interest rates, economic instability and geopolitical tensions, understanding the nuances of renting versus buying is crucial for making an informed decision.

Whether you are leaning towards the flexibility of renting or the long-term benefits of homeownership, understanding the current market trends and personal financial implications is key to making the best choice for your circumstances.

Key trends in the UK real estate market

Based on the provided statistics and insights from various sources, several key trends are shaping the UK real estate market in 2024:

Stabilisation of property prices

The UK housing market is experiencing a stabilisation phase, with average property prices showing a slight decrease of 0.2% overall. This suggests a cooling period following previous years of rapid growth, allowing the market to recalibrate.

There are also significant regional differences, with the North West experiencing a growth rate of 2.9%, while London faces a slight decline of 0.3%. This indicates a shift in demand towards more affordable regions, driven by factors such as work-from-home flexibility and lifestyle changes.

Northern Ireland has seen significant growth, with a 6.4% annual increase in property prices. In contrast, areas like the Southeast of England have faced a 5.7% decline.

The South East, particularly areas benefiting from the Elizabeth Line, has seen an 11% increase in sold prices since 2020, driven by urban regeneration projects.

Impact of high mortgage rates

The Bank of England's base rate of 5.25% has led to elevated mortgage rates, with two-year fixed rates averaging 5.10% and five-year rates at 4.80%. These high rates are impacting affordability, particularly for first-time buyers, and may deter some from entering the market.

As mortgage costs rise, more individuals may opt to remain in the rental market, increasing demand and potentially driving up rental prices. This trend highlights the ongoing affordability issues within the housing sector.

Demand for new builds

The average price for new builds increased by 16% to £406,000, reflecting strong demand for modern, energy-efficient homes. This trend is driven by buyers' preferences for properties with lower running costs and fewer maintenance issues.

The Labour government's focus on increasing housing supply through programs like the New Towns initiative may further stimulate the new build market, providing more opportunities for buyers and investors.

Legislative and economic influences

With inflation reaching the Bank of England's target, there is speculation about potential interest rate cuts. This could alleviate some affordability pressures and boost consumer demand, enhancing market liquidity.

The Renters (Reform) Bill and Leasehold and Freehold Reform Bill are poised to reshape the property landscape, affecting both landlords and buyers. These changes aim to improve tenant rights and make leasehold properties more attractive, potentially impacting investment strategies.

Prop-tech and innovation

The prop-tech sector is growing rapidly, with companies leveraging technology to streamline real estate processes, enhance customer experiences, and improve efficiency. This trend is expected to continue, driven by the need for data-driven decision-making and innovative solutions in the property market.

These trends suggest a complex but cautiously optimistic outlook for the real estate sector. This leaves renters, homebuyers and sellers alike navigating a dynamic market characterised by uncertainty and opportunity. Let's have a look at how rental and buyer markets look like in the UK today.

Renting guide

Renting offers flexibility and mobility, appealing to those who prioritise short-term savings and the ability to relocate easily. It involves fewer upfront costs and responsibilities, making it an attractive option for individuals who aren't ready to settle down or work in industries requiring frequent relocation.

However, renting doesn't build equity, and tenants may face rising rental costs and limited control over their living space.

On average, rents across the UK have been increasing. As of May 2024, the average rent in the UK was £1,226 per month, marking a 6.6% increase from the previous year. In London, rents are significantly higher, with averages around £2,086 per month, representing a 10.1% increase.

And while London has the highest rate, the North East has the lowest average rent at £667 monthly. Other regions like Wales and Yorkshire also have relatively lower rents compared to the national average.

On top of that, due to chronic housing storage of housing supply, investment dynamics, and population growth, there is a persistent imbalance between the demand for rental properties and available supply. For example, more than two-thirds of landlords reported increased tenant demand in 2023.

This is particularly because of a notable demographic shift where younger generations such as Millenials and Gen Z, are renting for longer periods due to delayed homeownership. Additionally, the number of older households (55+) renting has increased significantly, contributing to the heightened demand.

Advantages of renting

Renting a property in the UK offers several advantages, particularly in today's dynamic economic environment.

- Flexibility and mobility: Renting provides the flexibility to relocate without the complexities of selling a property. This is particularly advantageous in a dynamic job market where opportunities may necessitate frequent moves. For instance, professionals in sectors like technology or finance might find renting more suitable as it allows them to pursue career opportunities in different cities without being tied down by property ownership.

- Lower upfront costs: Renting typically involves lower initial expenses compared to buying a home. Renters usually need to cover a deposit (often equivalent to one month's rent) and the first month's rent, whereas buying a property requires a substantial deposit, mortgage fees, and stamp duty. This lower financial barrier makes renting accessible to a broader range of people, including those saving for a future purchase.

- Maintenance-free living: Under UK law, landlords are responsible for maintaining the property and addressing major repairs, as outlined in the Landlord and Tenant Act 1985. This means tenants are relieved from the financial burden of property maintenance, allowing them to focus on other financial goals.

- Avoidance of property market risks: Renters are not exposed to the risks associated with property market fluctuations, such as declining property values. This can be a relief in volatile markets where property prices are uncertain.

- Access to urban living: Cities like London, Manchester, Liverpool, and Birmingham continue to attract renters due to economic opportunities and the appeal of urban living. These cities offer strong rental yields and consistent demand, making them attractive for both tenants and investors.

Ultimately, renting provides flexibility and convenience, allowing tenants to enjoy their living spaces without the long-term commitments associated with homeownership.

Disadvantages of renting

Despite its benefits, renting also comes with a set of challenges that potential tenants should carefully consider before making a decision.

- Lack of investment: Rent payments do not contribute to building equity or ownership, often leading to the perception of rent as 'dead money'. This is a significant consideration for those looking to invest in their future financial security.

- Potential rent increases: Rent prices can fluctuate, often increasing annually. Recent trends show that average rents across the UK have risen by 8.7% over the past year, with significant regional variations. This can impact long-term affordability and necessitates careful budgeting.

- Affordability challenges: The average UK tenant spends 39.1% of their monthly income on rent with rental prices increasing faster than earnings.

- Limited control over property: Renters typically have limited ability to make changes or improvements to their living space. Restrictions on modifications, decorating, or even having pets can impact the comfort and personalisation of a rented home.

- Eviction risks: Section 21 of the Housing Act 1988 currently allows landlords to evict tenants without providing a reason, giving just two months' notice after the fixed term of a tenancy has ended. This has been criticised for creating instability for tenants and potentially leading to retaliatory evictions.

All in all, while renting can be suitable for many, understanding its drawbacks is essential to ensure it aligns with your personal and financial goals. As a renter, you have limited control over the property and may not be able to make significant changes or renovations to suit your personal preferences.

Renting tips

Navigating the rental market can be daunting, but with the right strategies, you can secure a property that meets your needs and budget.

- Know your rights: Familiarise yourself with tenant rights in the UK to ensure a fair rental experience. Key rights include living in a safe property, having access to necessary repairs, and protection against unlawful eviction. The Homes (Fitness for Human Habitation) Act 2018 requires landlords to maintain properties in a habitable condition.

- Research the market: With rents rising, it's crucial to stay informed about rental trends and negotiate terms that suit your financial situation. Reddit discussions often highlight the importance of leveraging online platforms and local forums like Rightmove, Zoopla, and OnTheMarket to gauge fair rental prices and identify potential deals.

- Discuss leasing terms: Engage in open discussions with landlords about lease terms. You could negotiate longer lease terms to lock in current rent rates, providing stability amidst rising rents.

- Research the laws: Track legal protections, such as the proposed abolition of Section 21 'no-fault' evictions, which aims to enhance tenant security. As of 2024, Section 21 evictions are still legal and can be used by landlords. You might want to discuss this with your potential landlord before making any decisions.

- Act quickly: Get your documents ready in advance (proof of income, employment verification letter, references from previous landlords, credit report, identification documents). Don't hesitate to schedule a viewing appointment for the earliest possible time slot, as desirable properties can be rented within hours of listing in hot markets.

By following these tips, you can approach the rental process with confidence and find a place that truly feels like home.

Buying guide

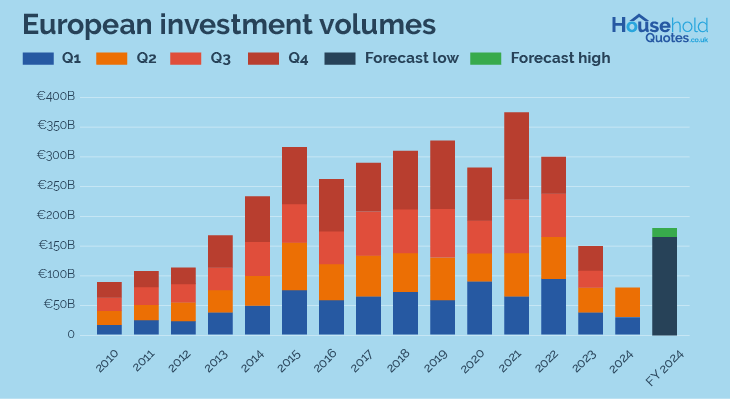

By the end of 2024, the Bank of England is anticipated to begin cutting interest rates from 5.25% to 4.5%, which could enhance investor confidence and market liquidity. The International Monetary Fund (IMF) optimistically forecasts a reduction of up to 3-4% by the end of 2025.

While these cuts are part of a broader strategy to stimulate economic growth and manage inflation, this news can boost investment volumes by 8-18% compared to 2023. This can make real estate investments more attractive due to reduced financing costs, potentially leading to higher property values and increased transactional volumes.

Mortgage market in the UK

The UK mortgage market in 2024 is characterised by high borrowing costs and economic uncertainty. The Bank of England's base rate is currently at 5.25%, following a series of increases aimed at controlling inflation. This has led to higher mortgage rates, with the average rate for a two-year fixed mortgage at 5.10% and a five-year fixed mortgage at 4.8% as of August 2024.

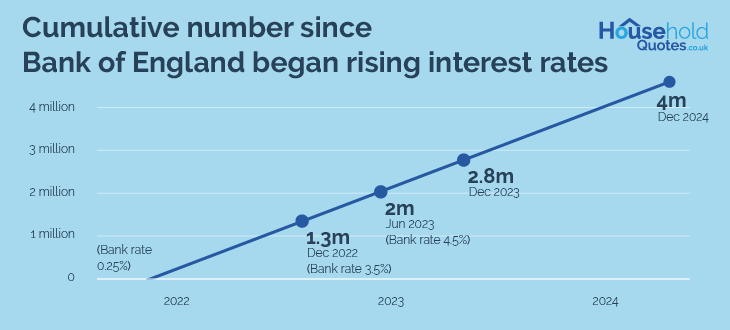

In fact, due to the rising interest rates 320,000 UK homeowners on a fixed-rate mortgage have been pushed into poverty, The Guardian reports. Up to 4.4 million UK homeowners with fixed-rate mortgages will face significant increases in monthly payments as their deals expire in December 2024.

This puts a lot of pressure on the government to intervene and provide support to households struggling with rising mortgage costs.

However, despite the high base rate, there have been slight reductions in mortgage rates recently. For example, the average rate for a 95% loan-to-value (LTV) 2-year fixed mortgage dropped from 5.94% to 5.90%. This could lead to potential market stabilisation and increased buyer activity, especially for first-time buyers.

To qualify for a mortgage, applicants need a stable income, a good credit score, and a deposit, usually around 5-20% of the property’s value. First-time buyers may benefit from government schemes like Help to Buy.

Advantages of buying real estate

Buying a property is a significant milestone that offers numerous advantages, from financial growth to personal satisfaction:

- Leverage: Putting 20% down on a property that appreciates 20% effectively doubles your initial investment.

- Appreciation: Historically, real estate has shown long-term appreciation, often outpacing inflation. For instance, the median home price in the U.S. increased from $172,900 (£132,437) in Q4 2000 to $417,700 (319,975) in Q4 2023, reflecting an average annual appreciation of over 6%. Although these figures are from the U.S., similar trends are observed in the UK, where property values have generally increased over time.

- Stable returns: Real estate investments can provide stable returns through rental income and appreciation, often outperforming stock market returns over the long term.

- Tangible asset: Unlike stocks, real estate is a tangible asset that can be used or improved, offering both personal utility and potential for value increase through renovations.

- Control and customisation: Property owners can make strategic improvements that can enhance property value. This control is unavailable with other investment types like stocks or bonds, where investors have little influence over the underlying asset.

Overall, with the potential for long-term benefits, purchasing a home can be a rewarding investment for those ready to take the plunge.

Disadvantages of buying real estate

While homeownership has its perks, it's important to be aware of the potential downsides before committing to a purchase.

- High initial costs: Purchasing real estate typically requires a significant upfront investment, including a down payment, closing costs, and potential renovation expenses.

For example, the average down payment for a home in the UK is around 15% of the property's value. For a median-priced home of £281,000, this equates to approximately £42,150.

Also, as of 2024, stamp duty land tax (SDLT) on investment properties starts at 3% for properties up to £125,000 and increases to 15% for properties over £1.5 million. It comes with an extra 3%, usually added to the standard rates for those buying additional residential properties.

- Market volatility: The real estate market can be unpredictable, with prices influenced by economic conditions, interest rates, and geopolitical factors. UK house prices fell by 1.8% in the year to November 2023, the largest annual fall since 2009.

On top of that, the Bank of England's base rate increase from 0.1% in December 2021 to 5.25% in August 2023 significantly affected mortgage rates and property demand.

- Maintenance and management: The average UK homeowner spends approximately £5,000 per year on home maintenance and improvements.

- Mortgage trends: Millions of UK homeowners with fixed-rate mortgages face significant monthly payment increases as their deals expire. The collective rise in mortgage payments is expected to reach £15.8 billion by 2026, with an average household facing an additional £2,900.

Weigh these disadvantages against your personal circumstances so that you can make a more informed decision about whether buying is the right choice for you.

Buying tips

Successfully purchasing a property requires careful planning and informed decision-making, especially in a competitive market.

- Assess financial readiness: Evaluate your financial stability, including income, savings, and credit score, before purchasing a property. In 2024, with fluctuating mortgage rates, maintaining a strong credit score is more important than ever. Ensure your credit report is accurate, and work on improving your score by paying off outstanding debts and making timely payments.

- Understand market trends: The UK housing market in 2024 is experiencing modest growth, with property prices projected to rise slightly. For instance, average UK house prices increased by 2.7% in the 12 months to June 2024, with regional variations in price growth. Therefore, staying informed about current market conditions, such as interest rates and housing demand is crucial.

- Explore government schemes: If you're a first-time buyer, you can use government schemes like the First Homes scheme or Shared Ownership to assist you with limited deposits.

- Know current laws and regulations: Before purchasing, familiarise yourself with the Stamp Duty Land Tax (SDLT) in your region, the Leasehold and Freehold Bill, Money Laundering Regulations, Consumer Protection from Unfair Trading Regulations (CPRs), and the Misrepresentation Act 1967.

For example, first-time buyers have relief on properties up to £300,000, paying no SDLT, and a reduced rate on properties between £300,000 and £500,000. With the Misrepresentation Act 1967, you are provided with a basis to claim compensation if they purchase a property based on incorrect or misleading information provided by the seller or their agent. Being aware of these and other regulations is crucial.

- Prepare for additional costs: Beyond the purchase price, buyers should budget for additional costs like stamp duty, legal fees, surveys, and potential renovation expenses. In a buyer's market, there may be room to negotiate on the asking price.

Therefore, understanding the property's market value and being prepared to make a reasonable offer can help secure a better deal. It's also important to be aware of the seller's situation, as motivated sellers may be more open to negotiation.

- Consider new builds: New builds are typically more energy-efficient, with modern insulation, double glazing, and efficient heating systems. They generate around 60% less carbon compared to older homes, leading to lower utility bills. Moreover, new builds come with warranties, such as the NHBC warranty covering structural defects for up to 10 years.

For off-plan purchases (before construction is completed), tools like Visuado provide 3D visualisations and renderings for off-plan designs, enabling buyers to experience properties virtually before they are built.

- Consider infrastructure projects: Investigate any planned infrastructure projects or developments in the area, such as new transport links or commercial centres. These can significantly impact property values and desirability.

In conclusion, the UK housing market is currently navigating a landscape marked by economic instability, inflation, and geopolitical factors, all of which contribute to market volatility and impact mortgage affordability.

These challenges underscore the importance of staying informed and adaptable in your property decisions. Engaging with mortgage advisors can be invaluable, as they offer insights into the latest regulatory changes and provide tailored advice to help you navigate the complexities of the real estate market effectively.

By leveraging expert guidance, you can make more informed decisions and better position yourself in a dynamic and ever-evolving housing market.