Get up to 4 quotes by filling in only 1 quick form

Compare quotes and find yourself the best deal

Increase the value of your home by installing solar panels

- Householdquotes.co.uk

- Solar Panel Cost

How Much Do Solar Panels In The UK Cost? (2024 Prices)

How much do solar panels cost in the UK? It can vary depending on the material used, the size of your system, installation and labour costs, additional components, and more. While the upfront price of solar panels in the UK can be £5,000 to £13,000 for a decent system, it can also lead to significant savings that make them worth the hassle of installation. Let’s go over the costs and how they can vary.

However, if you’re already looking to install solar panels, you’ll need an installer who you can rely on. Solar panels are a big investment so it’s important to know your installer is trustworthy. To make sure, you may have to undertake days of complicated and laborious research on your own. Thankfully, we offer a quicker and easier alternative.

Our service can provide you with 4 free, non-binding solar quotes from trusted installers in your area. All you have to do is fill out a 30-second form and we’ll give you access to the best prices the professionals in our network can provide. This way, you won’t have to personally reach out to companies and compare prices all by yourself. Click the button below to get started.

- Quotes from local installers

- Payment by finance available

- Save up to £660 per year

It only takes 30 seconds

What Is the cost of solar panels per system type?

| How much do solar panels save? | ||

|---|---|---|

| Electricity consumption per year | Solar panel system size | Annual electricity bill savings |

| 1,800kWh | 2-3 kW | £440 |

| 2,700kWh | 4-5 kW | £660 |

| 4,100kWh | 6 kW | £1,005 |

These costs are estimates. Get a local installer QUOTE now!

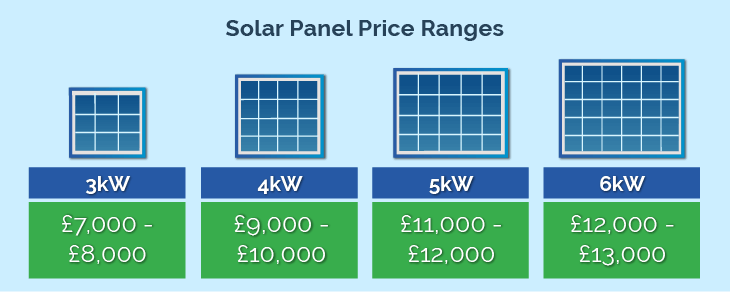

A 2kW system can cost from £5,000 to £6,000 while a 6kW system will net you about £12,000 – £13,000. Each successive kW helps you save more but will require extra roof space, so it’s good to find a balance between what your wallet allows and how much room you can give the panels with your desired savings.

The cost of solar panels for a 3 bedroom house amounts to £9,000 to £12,000 on average, while a single bedroom flat can get by with a £5,000 system. It’s worth noting that these prices do not include labour costs for installation or VAT (due to the 0% VAT policy for solar panels in the UK). Those can add £200 per kW for labour and 20% extra on the price tag, so the larger your system the larger the installation and VAT costs as well.

All these prices can vary based on a number of factors discussed below.

Which factors affect the costs of solar panels?

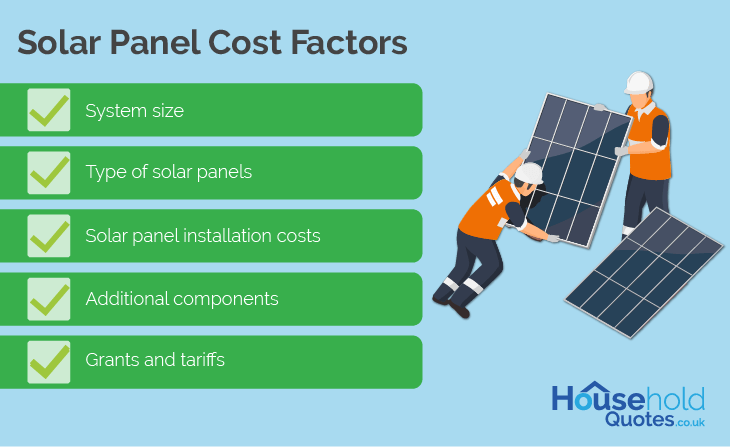

The cost of shifting to solar can vary from situation to situation. This is one of the reasons both the installation and the supply price of the solar system are difficult to calculate with precision. Solar panel price factors include the following.

- System size: The power of your system is the main determinant of cost, adding roughly £1,000 to £2,000 per kW.

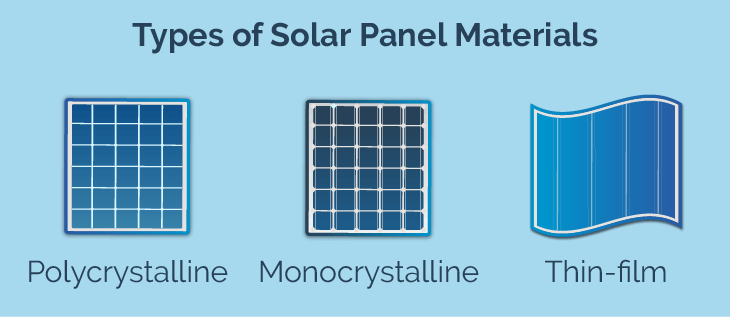

- Type of solar panels: The material and design can have a major impact on the supply cost. The main 3 materials include monocrystalline, polycrystalline, and thin-film.

- Solar panel installation costs: What solar panel installers charge can vary depending on the complexity of the job. In-roof solar panels can be more difficult to install, for example, so their prices are higher.

- Additional components: Adding parts like a solar battery or cleaning systems can push up the price but also keep future maintenance costs down and increase solar panel lifespan.

- Grants and tariffs: Various grants can help pay for solar panels and their installation, including the ECO4 scheme and VAT reduction. These can greatly reduce the supply price for solar panels in the UK.

System size

As mentioned earlier, the cost of PV panels is the main determining factor which can drag up the price. The bigger the size, the more expensive it will be and provide more energy. It’s important to note that size generally refers to the power, measured in kW. Solar panel costs in the UK can be £1,000 to £2,000 per kilowatt added.

Although the most popular choice of system is 4kW, the per kW price rate gets cheaper for systems that are 5kW and larger, allowing for a discounted price. A 5kw solar system price in the UK will set you back between £11,000 and £12,000, while a 4kW system can be £9,000 to £10,000.

So far, the biggest system available is the 12kW solar panel system, costing between £15,000 and £17,000 on average.

Matching the size of your solar panels to your household needs is necessary because if the panel is too small you might not be able to recoup sufficient energy savings. If, on the other hand, the panels are too big, you may end up wasting the energy they are generating (unless you plan to export it back to the grid or have a solar panel battery storage installed).

Type of solar panels (PV)

How much is a solar panel? About £1 to £1.50 per watt for monocrystalline panels. Polycrystalline and thin film can be cheaper on average but they also sport less efficiency. Ultimately, PV panels cost more for monocrystalline but they generate more electricity from each hour of sunlight.

| Solar panel materials | |

|---|---|

| Materials | Average Cost per kW |

| Monocrystalline | £1,000 – £1,500 |

| Polycrystalline | £800 – £1,200 |

| Thin-Film | £600 – £800 |

These costs are estimates. Get a local installer QUOTE now!

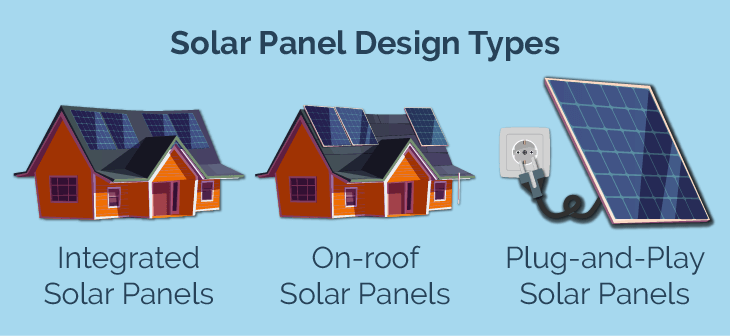

Another aspect that can influence the price is the type of system and its layout. This influences the look, functionality, and efficiency of the panels it contains. It also affects the solar panel cost as integrated solar panels, aka solar roof tiles, are the most expensive option and plug-and-play are the cheapest ones.

| Solar panels UK price per design type | |

|---|---|

| Solar Panel Design | Average Cost |

| On-roof solar panels | £1,000 – £1,500 per kWp |

| Integrated solar panels/tiles | £1,200 – £3,000 per kWp |

| Plug-and-play solar panels | £400 – £1,200 per 400W |

These costs are estimates. Get a local installer QUOTE now!

The final solar installation cost can be impacted by both the material and the design. Integrated or solar roof tile costs tend to be higher since they can take a lot more work than the standard on-roof systems but they are generally considered more aesthetically pleasing. However, one downside is that they have a little less efficiency than their on-roof counterparts.

Plug-and-play systems tend to be very cheap but they are also less efficient and come in smaller sizes. They can be a viable option if you have very little space or live in an apartment that doesn’t allow for installations. You can use them to produce energy for small appliances.

Solar panel installation cost & labour

So, how much are solar panels with the labour included? The cost of installing solar panels can differ based on how many solar panels you need and how extensive the job is. It can also be up to the installer and their rates.

Installation costs of commercial solar panels can be estimated at £0.20p per watt fitted. This would mean that you can add roughly £200 per kilowatt.

These prices are estimates but the real cost can vary from installer to installer, which is why it’s important to find one you can trust after checking with multiple installers. While this would usually take days of scanning through companies and figuring out which ones have the best deals, we can take the load off of your shoulders with our quick and easy service.

All you need to do is fill out a 30-second survey and we’ll handle the rest by providing you with up to 4 free, non-binding solar quotes from trusted installers in our network. No need to go through the headache of doing it all by yourself. Click the button below to get started.

- Quotes from local installers

- Payment by finance available

- Save up to £660 per year

It only takes 30 seconds

Additional components

Solar panels are much more useful and long-lasting if you spring for additional components you might need (depending on your situation). Monitoring systems and software can be great for ensuring your energy efficiency is always on point. Moreover, certain components can have their own specifications, which is why solar battery prices range so widely, from £5,000 to £13,000.

Other additions like pigeon-proofing can help keep direct sunlight on your panels. This may cost £50 or more per panel for a simple wire mesh or over £150 per panel for complex elements like skirts. You may need these if you live in an area where wildlife is a concern.

Below, we’ve provided some averages for solar panels that you should use as a benchmark.

| How much does it cost to install solar panels in the UK? | |

|---|---|

| Cost Breakdown | Average Cost Range (£) |

| Solar Panels | £2,500 – £11,000 |

| Mounting Systems and Racking | £600 – £2,500 |

| Inverters | £1,000 – £3,000 |

| Electrical Work | £600 – £3,000 |

| Energy Storage Systems / Solar Batteries | £2,000 – £10,000 |

| Monitoring Systems (Optional) | £500 – £1,500 |

| Labour cost for panel installation | £200 per kW fitted |

| Pigeon-proofing | £50 – £160 per panel |

| Total Installation Cost (Estimated Range) | £6,700 – £33,000 or More |

These costs are estimates. Get a local installer QUOTE now!

Solar panel maintenance costs

Given how much solar panels cost in the UK, you will want to keep them in top shape and safe from harm. Maintenance and safety measures are the best way to ensure you’re getting your money’s worth. Luckily, cleaning panels is not a strenuous or frequent task.

One of the big advantages of solar panels is that they are low maintenance, requiring an occasional cleaning every month or so. Cleaning kits can cost between £50 and £500, but what you usually need is some biodegradable soap, a wiper, and a brush (preferably one with minimal chance of leaving scratches i.e., a softer brush).

You can also hire a service to do the cleaning but this may not be suitable for everyone’s budget. Such companies generally charge £5 to £15 per panel so this can get expensive at scale and over a long time. If monthly cleanings are an issue it would be best to do it manually rather than hiring a company, especially since cleaning solar panels is usually an easy task.

If this all sounds like too much of a hassle, you could install automated cleaners that operate like a sprinkler system. These can periodically clean the panels on their own. Cleaning systems for solar panels can range from £2,000 to £3,500, depending on the type. Some are cleaning robots while others are sprinkler-type systems, with the latter being cheaper.

How much do you save with solar panels?

Savings can vary based on the sunlight hours your location gets, the size of the solar panel system you installed, and its efficiency. Aside from the money you save, generating excess energy can have its own advantages. Under the Smart Export Guarantee (SEG), you can also export back to the grid to earn money for yourself.

| Solar panel cost UK | |||||

|---|---|---|---|---|---|

| House size | Electricity consumption per year | Solar panel system size | Number of solar panels (350W) | Roof space | Annual electricity bill savings |

| 1-2 bedroom | 1,800kWh | 2-3 kW | 5 – 8 | 10 – 16m2 | £440 |

| 2-3 bedrooms | 2,700kWh | 4-5 kW | 10 – 13 | 20 – 26m2 | £660 |

| 4-5 bedrooms | 4,100kWh | 6 kW | 16 | 32m2 | £1,005 |

These costs are estimates. Get a local installer QUOTE now!

How long do solar panels last?

On average, the lifespan of a solar panel is about 25 to 30 years. This is an ample time period to get payback if you have a system larger than 3kW. Compared to solar panel prices in the UK, the payback period can save you a lot of electricity payments.

Solar panels can last longer with regular maintenance and upkeep. To make sure there isn’t something wrong with your system it can be handy to install monitoring tools and software. Certain tools like smart home monitoring systems can let you map out performance over large time periods, which could give you an indication of whether their performance is declining.

Solar panels break-even point

The payback period of your solar panels can depend on the cost of the panels and how much energy they produce (i.e., the size of the solar system you install). Here are a few estimates of how much time it can take for solar panels to rake in the savings, assuming optimal savings annually.

| Break-even period of solar panels | |

|---|---|

| System Size | Estimated Payback Time (Years) |

| 3kW | 17 |

| 4kW | 14 |

| 5kW | 17 |

| 6kW | 12 |

How to reduce solar panel costs

Solar panel installation costs in the UK can be a drain, so it’s only natural that you’d want to save as much as possible. Since every little bit helps, here are some good cost-saving measures that can come in handy.

You can always save more on your solar panel installation by opting for a grant if it applies to your area (more on this in the next section). These grants are designed to help homeowners and people on low income, depending on the focus of that particular policy measure. Be sure to check your eligibility for them.

One of the ways to save money is to go for DIY installation. While we do not recommend this unless you are a professional, this can be a good way to cut out the middleman. Needless to say, it requires technical know-how and effort. Also, incorrect installation could irreparably damage your house.

In general, a consumer should go with the lowest cost per installed Watt of a solar system after getting at least three quotes from installers. The installers will select panels based on market availability, and their own experience, essentially what they have access to and use regularly.

Joshua M. Pearce is the John M. Thompson Chair in Information Technology and Innovation. He holds appointments at Ivey Business Schooland the Department of Electrical & Computer Engineering at Western University. He runs the Free Appropriate Sustainability Technology research group.

Even aside from going the DIY route, you can save money on solar panel installation and installer fees. To do this, you will need to find an installer you can trust, which can be a difficult task that requires days of research and number-crunching when comparing prices. However, our service can cut that time down to a minimum and all you have to do is fill out a 30-second form with some basic info.

We have thoroughly vetted all the installers in our network so you can rest assured they’re up to the task. Once you receive your quotes, you can then pick the offer that suits you best. What’s even better is that all solar quotes we provide are non-binding and absolutely free. Click the button below to start saving on your electricity costs.

- Quotes from local installers

- Payment by finance available

- Save up to £660 per year

It only takes 30 seconds

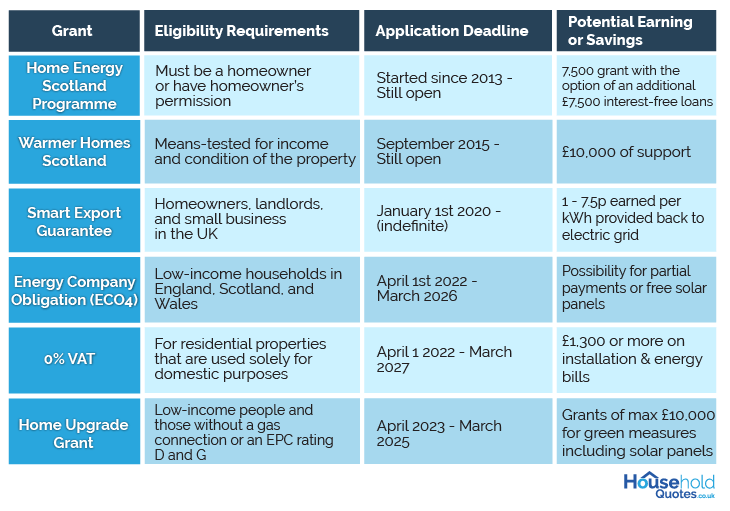

Are there solar panel grants available?

There are multiple handy solar panel grants and government programs that can help you obtain a solar system far more affordably. You may even be eligible for free solar panels. This is why the cost of solar panel installation in the UK can be a bit more forgiving if you’re aware of the programs that can subsidise you.

How expensive are solar panels with a grant? With the ECO4 scheme, it can depend on your eligibility and the status of your house, but the scheme can potentially pay for a whole solar panel setup.

Warmer Homes Scotland provides £10,000 of support to specific households allowing for a £300 average reduction in annual heating costs. This requires the permission of a landlord so make sure you have it if you are not a homeowner. While it applies to heating and insulation, it also covers solar panels in Scotland.

The Home Energy Scotland program offers grants of up to £7,500 each to pay for installation and an additional £7,500 interest-free loan. These grants and loans are geared towards energy efficiency improvements and zero-emission heating improvements, which include solar panels.

On the earnings side, the Smart Export Guarantee allows you to make back some of your investment in the form of the excess energy you create and then feed back into the grid. You can earn up to 29.3p per kWh provided back to the electric grid.

The 0% VAT policy puts certain technologies in a specialised tax exemption category allowing you to save VAT on them. This can be as much as £1,300 for heat pumps, solar panels, or other sustainable installations.

While the Home Upgrade Grant is primarily geared towards heating and electricity-saving solutions, it also includes green measures such as solar panels. It can provide up to £10,000 in savings for your solar installation.

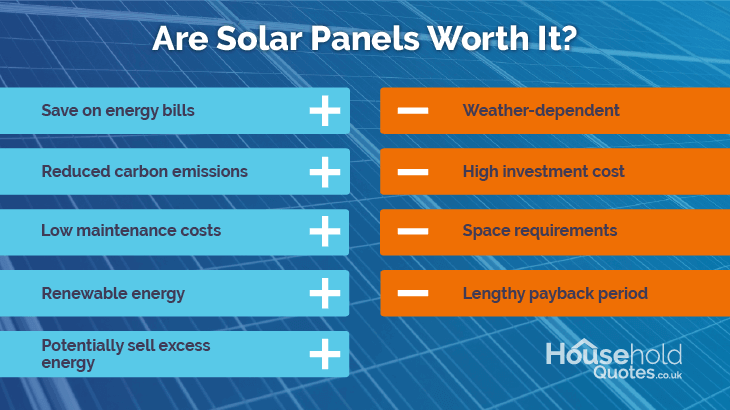

Are solar panels worth it?

Solar panels can be a great way to reduce costs and break free of the fossil-fuel-based electric grid. Sounds great, right? Here’s the catch: there are circumstances where they can and can’t be appropriate for your home. For one thing, since solar panels are reliant on sunlight, you will need a location with decent sunlight exposure and sunlight hours.

You will also need a roof or an array that faces South, as it is the best angle for solar panels in the UK. While other directions can still make use of adequate sunlight, you may not get maximum utility from your installation and your payback period will be longer. Similarly, the zone around the solar panels needs to be unobstructed by shade.

If you meet these criteria, with the right system, you can cut costs and even earn money by giving back to the electric grid. Installation can even increase the value of your property by about 4.1%, according to Zillow. While there are a ton of different reasons to get them, make sure you know what type of system you need and if your home is suited to the installation.

We especially recommend installing a solar panel system if your home is eligible for any of the grants we mentioned earlier. All in all, there has never been a better time to opt for solar, with gas prices increasing and solar panels getting cheaper annually.

Get the best solar panel prices for your household in the UK

The best way to find out how much solar panels are in the UK is to ask an installer. However, finding an installer you can trust can be an arduous task requiring hours of research and painstaking price comparisons. Not everyone has time for that, which is why our service is here to help.

All you have to do is fill out a 30-second form and we’ll help you obtain up to 4 free, non-binding quotes from experts in your area. All the installers in our network have been thoroughly vetted so you can be sure that you’ll get the quality service you deserve. Click the button below to get started, especially if you want to install them but are wondering “Where can I find solar installers near me?”.

- Quotes from local installers

- Payment by finance available

- Save up to £660 per year

It only takes 30 seconds

Frequently Asked Questions

A new solar battery costs anywhere between £2,500 and £10,000, depending on the storage capacity of the battery you need. You can check the estimated prices for different capacity solar batteries.

Yes, you can. There are a few grants available for solar batteries. You should check whether you are eligible for any of these, as the grants can be a great way to reduce your expenses when it comes to installing your solar battery storage.

A 10kW solar battery storage system costs somewhere between £7,500 and 9,500. However, the exact cost depends on several different factors such as solar battery type and installation costs.

For a 5kW solar battery, you can expect to pay around £4,000 – £5,000. You might end up spending more or less on your system based on a number of factors that affect the total cost of having a solar battery installed in your home.

Based on the storage capacity of the solar battery you need, an estimated price range for adding a new solar battery to your solar energy system is £2,500 – £12,500. You can lower your expenses by applying for solar battery grants and checking how they work with your existing solar system.

Purchasing your solar battery and solar panels at the same time can sometimes mean lower costs. However, with the price of solar panel systems ranging from £5,000 to £13,000 and solar battery costs being around £2,500 – £10,000, you are still looking at a rather high initial investment.

Rawal Ahmed is a writer at Household Quotes with an interest in sustainability and a background in tech journalism and digital marketing.